Pure Storage today shared an update on the company’s business momentum as well as their predictions for the industry in 2023. Globally, the company continues to record solid growth. For its fiscal third quarter, ended November 6, 2022, Pure recorded revenue of US$676 million, up 20% year-over-year and subscription services revenue of US$244.8 million, up 30% year-over-year.

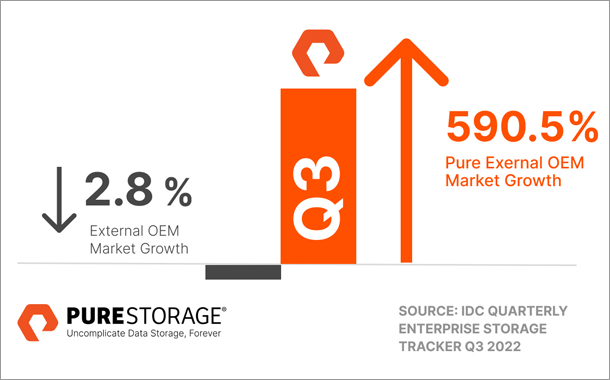

In India, Pure continues to execute well on its strategy of providing the most advanced, reliable, and energy-efficient technology to satisfy the mission-critical data storage and management needs of its customers and this has been demonstrated by its continued ability to outpace the market. According to the IDC Quarterly Enterprise Storage Tracker, in Q3, 2022, Pure grew 590.5% while the overall market in India declined by 2.8%.

“The transformation of India into a digital economy is taking place at an astonishing pace, accelerated by the pandemic. Pure’s technologies are a critical enabler for this digitalisation and we are grateful to our customers and partners for putting their faith in our ability to support their digital transformation,” said Ramanujam Komanduri, Country Manager, India, Pure storage.

2023 Predictions

Pure also shared its predictions for what will happen in 2023. “Amid rising inflation and recession risks, strengthening resilience, reducing the total cost of ownership, and optimising resources will move up the corporate agenda. This will have implications for technology investments in the region,” said Sudharsan Aravamuthan, Head of Systems Engineering, India, Pure Storage.

Future of flash: 2023 will be the year of density for flash storage

Advancements in flash storage such as QLC (quad-level cell) and DirectFlash are lowering the cost and increasing density in flash to the point where many organisations are starting to replace their legacy spinning disk storage with flash. With increasing scrutiny on environmental sustainability, the energy and space savings that they get from flash is another reason why companies are moving away from legacy spinning disk. In 2023, we expect to see densities in flash storage really take a leap forward, increasing its suitability for Tier 2 and even Tier 3 workloads.

Anywhere Service Economy: Barriers to Anywhere Service Economy will be lowered further in 2023

The shift in investment in IT towards flexible consumption models such as subscription-based and pay-as-you-grow methods will accelerate in 2023. This is being driven by a cultural shift within organisations particularly those that depend on external investors. Investment bodies and boards of directors are increasingly looking favourably at companies that don’t hold a lot of capital assets. This provides them with the financial flexibility to invest in more strategic areas of the business. This will result in the Anywhere Service Economy expanding even further in 2023.

Supply chain: Manufacturing processes will be re-architected to mitigate supply chain disruptions

Businesses will be hard-pressed to rethink their software development/product engineering cycles, as supply chain issues persist amid geopolitical tensions. This will lead organisations to consider a more modular approach that will enable them to reuse and repurpose standard components. Such an approach offers greater flexibility to complete projects in the face of supply chain disruptions, while preventing duplicated efforts in the software development lifecycle. By rejigging software development and product engineering processes to incorporate part reusability, organisations can better mitigate supply chain risks and strengthen resilience.

ESG: ESG accountability will filter from the boardroom deep down into the organisation

ESG will continue to increase in importance for most companies, but there will be a renewed focus on accountability and demonstrated action. Governments are coming up with policies and tax regulations to limit carbon emissions, and organisations will need to comply with new standards. Investors, partners, and consumers are increasingly considering ESG practices and performance in their decision to support an organisation. With stakeholders demanding ESG integrity, there is ongoing pressure to drive organisation-wide transformation that encompasses ESG strategy and reporting. There will also be increasing focus on Social and Governance aspects of ESG not just to meet regulations but to meet expectations of customers, partners and employees.

Data protection: Data security will shift towards rapid recovery capabilities

The threat goes beyond ransomware: data retrieval and recovery is no longer a given, in spite of paying attackers their desired ransom. With hackers changing their tactics from merely locking data for ransom to outrightly stealing data, relying on cybersecurity insurance policies as a last-resort safety net can no longer provide adequate data protection in 2023. Organisations will be more inclined to take a “safer data” approach – employing unified fast file and object storage platforms that provide the last line of defence against ransomware or rogue employees, while offering quick recovery speeds.

Containers: Nanoservices will enter the conversation in 2023

With increasing adoption of containers and microservices, 2023 will see nanoservices start to enter the conversation. These are designed for single function applications and are even simpler to run than microservices. An example would be a news site that uses a nanoservice to just run headlines or pull in weather data.