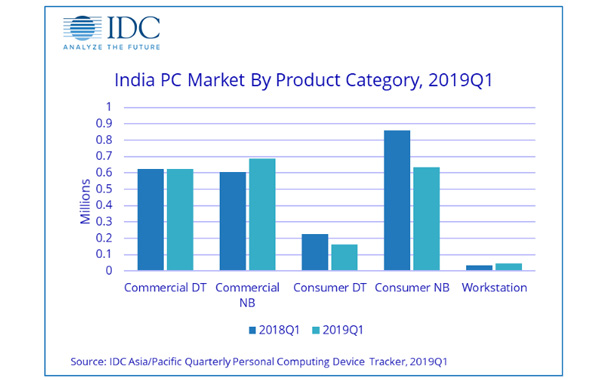

The India traditional Personal Computing (PC) market declined for the third consecutive quarter in 2019Q1 according to IDC’s Asia/Pacific Quarterly Personal Computing Device Tracker, 2019Q1. The market witnessed a year-on-year (YoY) drop of 8.3% with shipments reaching 2.15 million units in 2019Q1.

The market remained weak outside big commercial deals due to weak consumer demand, high inventory from previous quarters, and supply issues for Intel chips. The announcement of central elections on March 10th, 2019 resulted in the model code of conduct coming into immediate effect further resulting in a delay in execution of government projects and impacting the commercial segment.

Notebook category contributing 61.4 percent of the overall India traditional PC market shipments witnessed a 9.8% YoY decline. Within Notebooks, Ultraslim category, with a 25.3% share of the market, grew by 86.5%.

“Spending towards Ultraslim notebooks is increasing as owing to factors such as improved mobility due to the thinness of the product and enhanced aesthetics,” says Bharath Shenoy, Market Analyst, PCs, IDC India. “Business sentiment has been on the lower side as enterprises look to wait and watch before taking any major decision due to ongoing elections in 2019Q2; the model code of conduct came into the picture in 2019Q1, thereby delaying the Government and Education projects. Demand from BFSI and IT/ITES sector remained good in 2019Q1 but the main segment driver was ELCOT,” adds Shenoy.

IDC anticipates the overall India traditional India PC market to witness a growth in 2019Q2 over last quarter driven by further shipment of ELCOT. The commercial market is expected to pick up post new government formation in end of May. “The consumer market is expected to pick up largely driven by back to school campaign by vendors and online sales creating a pull to attract consumers through various schemes and financial incentives such as EMIs/Cashbacks,” says Nishant Bansal, Senior Research Manager, IPDS & PCD, IDC India.

“Commercial spending due to refresh and fresh demand by large and medium enterprises is expected to continue led by Education, BFSI, and IT/ITeS sector. The public sector is expected to pick up post elections, once the new Government comes into power,” adds Bansal.