Canalys Forums 2023, apart from being a platform for networking, brought together partners, principals, and delegates from various geographies.

The three-day Canalys conference held at Hotel Avani Riverside in Bangkok once again served as a pivotal gathering for APAC partners, providing a perfect blend of entertainment and information. Beyond being a hub for networking, it brought together partners, principals, and delegates from various regions for meaningful interactions.

The recipe of the event comprised more than 32 sessions including 9 keynote sessions from the organizer and the sponsor, 2 health and fitness sessions and 1 media round table session. There were more than 1000 visitors with 95% partners from the region and rest delegates from various principal companies and organizers.

“As the pandemic ended, our business became more challenging, but tourism and events are now booming. People are eager to reconnect, and both Canalys and our parent company have witnessed record attendance across events.”

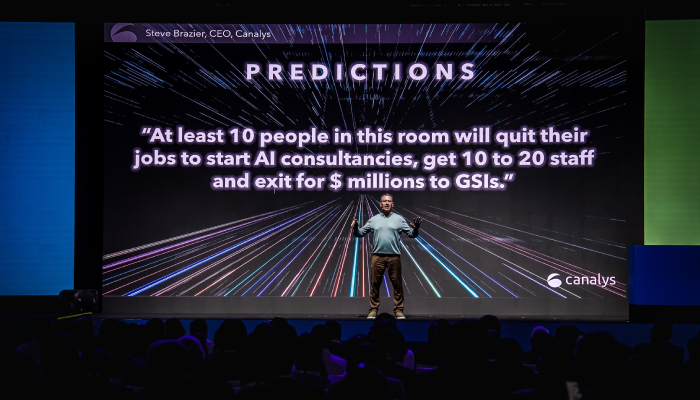

Steve Brazier, President and CEO of Canalys

Canalys Forums produces the highly influential, good quality independent channels events where the full ecosystem is supported: vendors, distributors, and channel partners. The Canalys Forums APAC 2023 is a gathering of the brightest minds in the IT channel, which discussed the industry’s latest news, key forecasts and strategies. It offered a great opportunity for top partners and venders to meet in one single location to educate each other and build a bright business future together.

The events support thousands of face-to-face meetings, Expert Hub panel discussions and private roundtables. The quality and depth of market insights shared by the world’s largest team of channel-focused analysts set the Canalys Forums apart from other channel events.

Delivering the keynote address, Steve Brazier, President and CEO of Canalys, said, “Ten years ago, when we held this event in Bangkok, this hotel didn’t exist. If you haven’t been to Bangkok in the last few years, it’s astonishing how much the city has changed and modernized, becoming one of the coolest places in the world.”

“We went through a pandemic – business was good, life was boring, and tourism suffered, affecting Thailand and many other countries. As the pandemic ended, our business became more challenging, but tourism and events are now booming. People are eager to reconnect, and both Canalys and our parent company have witnessed record attendance across events,” added Brazier.

During the pandemic, business people needed to communicate and engage, especially when not going to offices. Although it was an extraordinary time, the world has changed again since the pandemic. The cost of money has skyrocketed, creating ripple effects across many industries. There has been a small banking crisis in the US in the first half of this year, and a potential crisis looms in private equity. Private equity teams played a game of investing in a company, owning it for three years, selling it to another private equity company at a higher valuation, and so on. Now, with the inability to sell at a higher valuation, private equity companies find themselves in a challenging situation, possibly leading to a crisis over the next 12 months.

Meanwhile, the startup venture capital business has dried up, and bootstrapping is becoming more common. The rising cost of holding inventory has suddenly made it expensive, and managing cash has become a different situation. Economic slowdowns and difficult economic situations are evident in many parts of the world. Unfortunately, in many countries, it’s not clear that politicians prioritize economic growth, marking a shift from the norm. In China, the government’s backlash against the tech industry has led to a real economic slowdown. Wages are no longer increasing, and property prices are falling. The US has blocked the export of some semiconductors to China, potentially justified on military grounds but economically detrimental to both countries. China, once a major contributor to global growth, is no longer providing that support, impacting the global economy. The German car industry, for example, is experiencing challenges as well.

In 2023, a substantial 39% of respondents in the Asia-Pacific (APAC) region anticipate robust revenue growth exceeding 10%. Furthermore, over 60% of APAC channel partners foresee an increase in profits, with 20% expecting significant growth. Canalys also shares in the optimism expressed by these partners.

The growth outlook in the APAC region revolves around various opportunities. Managed services, cybersecurity services, XaaS (including SaaS/IaaS/Das), and cloud solutions (hybrid, migration) are anticipated to be the primary drivers of growth. Recent data from Canalys supports this positive outlook. For instance, Canalys predicts that the APAC cybersecurity market will surge by 12% in 2023, surpassing US$11 billion, fueled by the growth in developing markets like Greater China and India, as well as decent growth of 7% to 11% in established markets.

In the realm of cloud infrastructure, Canalys forecasts a remarkable 23% growth to reach US$304 billion in 2023, compared to the previous year. This growth trend is expected to be consistent across APAC countries, with double-digit increases.

The survey indicates that more than 70% of APAC partners are prioritizing a shift towards professional and managed services in 2023. This shift is fostering closer collaboration in customer projects, aiming to deliver business outcomes through a digital-led approach.

Expectations for managed services are sky-high in the channel, with more than three quarters of partners forecasting growth of their managed services revenue in 2023. Some 79% of partners surveyed by Canalys expect growth in their cybersecurity revenue in 2023